Platform-Based Payment Gateway Market Poised for Rapid Growth Amid Rising Digital Transactions and E-Commerce Expansion

Platform-Based Payment Gateway Market Poised for Rapid Growth Amid Rising Digital Transactions and E-Commerce Expansion

Blog Article

"Platform Based Payment Gateway Market Size And Forecast by 2032

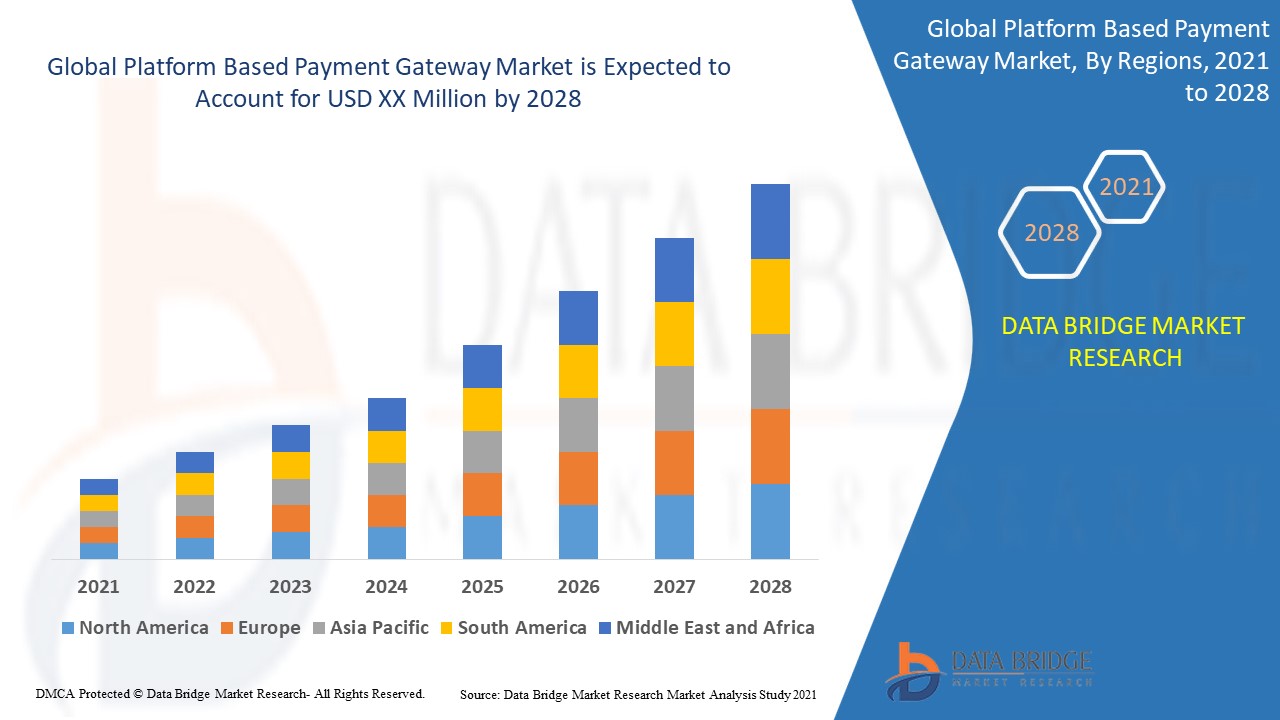

According to Data Bridge Market Research The global platform based payment gateway market size was valued at USD 26.37 billion in 2024 and is projected to reach USD 33.93 billion by 2032, with a CAGR of 3.20% during the forecast period of 2025 to 2032. I

Our comprehensive Platform Based Payment Gateway Market report is ready with the latest trends, growth opportunities, and strategic analysis. https://www.databridgemarketresearch.com/reports/global-platform-based-payment-gateway-market

**Segments**

- **By Type:** The platform-based payment gateway market can be segmented based on type into hosted payment gateways, self-hosted payment gateways, and local bank integration.

- **By Deployment:** Deployment segments include cloud-based and on-premises payment gateways.

- **By End-User:** This segment categorizes the market according to end-users such as large enterprises, small and medium enterprises (SMEs), and individual users.

- **By Industry Vertical:** Different industry verticals using platform-based payment gateways include retail, healthcare, BFSI (banking, financial services, and insurance), e-commerce, and others.

**Market Players**

- **PayPal Holdings, Inc.:** One of the leading players in the platform-based payment gateway market, offering a wide range of solutions for online payments.

- **Stripe:** Known for its developer-friendly payment gateway solutions and APIs that cater to businesses of all sizes.

- **Square, Inc.:** Provides payment processing solutions for small businesses, including in-person, online, and mobile payments.

- **Adyen:** A global payment company that enables businesses to accept payments in a single platform.

- **Amazon Pay:** Offers a secure and seamless payment experience for customers on various websites and apps.

The global platform-based payment gateway market is witnessing significant growth due to the increasing adoption of digital payment methods, growing e-commerce industry, and the need for secure online transactions. Hosted payment gateways, which offer easy integration and PCI compliance, are in high demand among businesses of all sizes. Cloud-based deployment is gaining traction due to its scalability and cost-effectiveness compared to on-premises solutions. Large enterprises are major users of platform-based payment gateways, but SMEs and individual users are also increasingly embracing these solutions. In terms of industry verticals, retail and e-commerce sectors are leveraging payment gateways to enhance customer experience and streamline transactions, while the healthcare and BFSI sectors are focusing on secure and compliant payment processes.

Key market players such as PayPal, Stripe, Square, Adyen, and Amazon Pay are investing in innovative technologies and strategic partnerships to expand their market presence and offer advanced payment solutions to their customers. These companies are focusing on enhancing security features, improving transaction speed, and providing a seamless payment experience across different platforms. The competitive landscape of the platform-based payment gateway market is intensifying as new entrants and established players compete to gain a larger market share and meet the evolving needs of businesses and consumers.

For more detailed insights and market trends, refer to https://www.databridgemarketresearch.com/reports/global-platform-based-payment-gateway-market The global platform-based payment gateway market continues to evolve as businesses across various industries embrace digital payment solutions to cater to the increasing demand for convenient and secure online transactions. The market segmentation based on type, deployment, end-user, and industry verticals provides a comprehensive understanding of the diverse needs and preferences of users within the payment gateway ecosystem. Hosted payment gateways are gaining popularity due to their ease of integration and compliance with payment card industry (PCI) standards, making them a preferred choice for businesses looking for a straightforward payment solution. On the other hand, self-hosted payment gateways offer more control and customization options, appealing to businesses with specific requirements for their payment processing needs. Local bank integration is crucial for businesses operating in regions with specific banking regulations and preferences, highlighting the importance of catering to local payment methods.

The deployment of cloud-based payment gateways is on the rise, driven by the scalability, flexibility, and cost-effectiveness they offer compared to traditional on-premises solutions. Cloud-based solutions enable businesses to scale their payment processing capabilities according to demand, ensuring efficient transaction processing and reducing operational costs. In contrast, on-premises payment gateways are favored by organizations that prioritize data control and security, particularly in highly regulated industries such as healthcare and finance. The choice between cloud-based and on-premises deployment largely depends on the specific requirements and risk tolerance of businesses, emphasizing the importance of offering diverse deployment options to cater to various preferences.

Large enterprises, small and medium enterprises (SMEs), and individual users form distinct segments within the platform-based payment gateway market, each with unique needs and expectations regarding payment processing. While large enterprises often require robust and scalable payment solutions to handle high transaction volumes, SMEs seek cost-effective and user-friendly payment gateways that can adapt to their growing business needs. Individual users, on the other hand, value simplicity, security, and seamless payment experiences when making online transactions, highlighting the importance of catering to the diverse needs of end-users across different segments.

Various industry verticals leverage platform-based payment gateways to enhance customer experience, streamline transactions, and ensure secure payment processing. The retail and e-commerce sectors prioritize seamless payment experiences to drive sales and build customer loyalty, while the healthcare and BFSI sectors focus on compliance, security, and data protection to safeguard sensitive information. The growing adoption of digital payment methods and the increasing emphasis on online security and compliance drive the demand for advanced payment solutions tailored to the specific requirements of each industry vertical.

In conclusion, the platform-based payment gateway market is poised for continued growth and innovation as market players invest in technology advancements, strategic partnerships, and enhanced security features to meet the evolving needs of businesses and consumers. The competitive landscape is characterized by intense competition, with both established players and new entrants vying for market share by offering differentiated solutions and superior customer experiences. As digital payments become increasingly prevalent across industries, the platform-based payment gateway market will continue to evolve to meet the demands of a rapidly changing business environment.**Segments**

Global Platform Based Payment Gateway Market, By Application:

- Micro and Small Enterprises

- Large Enterprises

- Mid-Size Enterprises

End User:

- BFSI

- Medi Entertainment

- Retail & E-commerce

- Travel & Hospitality

- Others

Country:

- U.S.

- copyright

- Mexico

- Brazil

- Argentina

- Rest of South America

- Germany

- France

- Italy

- U.K.

- Belgium

- Spain

- Russia

- Turkey

- Netherlands

- Switzerland

- Rest of Europe

- Japan

- China

- India

- South Korea

- Australia

- Singapore

- Malaysia

- Thailand

- Indonesia

- Philippines

- Rest of Asia-Pacific

- U.A.E

- Saudi Arabia

- Egypt

- South Africa

- Israel

- Rest of Middle East and Africa

Industry Trends and Forecast to 2032.

**Market Players**

The major players covered in the platform-based payment gateway market report are:

- Alipay

- Amazon, Inc.

- Wirecard

- PesoPay

- PayU

- PayPal

- Paymill

- MOLPay

- eWAY AU

- Net

- Worldpay

- Beanstream

- Stripe

- Klarna

- Realex

- CashU

- WebMoney

- Pagosonline

- 99bill

- MyGate

- ServiRed

- Payson

- Cardstream

- Sage Pay

- e-Path

- NAB Transact

- MercadoPago

- CCBill

Among other domestic and global players. Market share data is available for global regions like North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and South America separately. Databridgemarketresearch analysts provide detailed competitive analysis for each competitor separately. The global platform-based payment gateway market, segmented by application, end-user, and country, shows a comprehensive understanding of the market's dynamics and potential growth areas. The inclusion of various industry verticals and regions provides insights into the diverse needs and preferences of users across different sectors and geographies. As businesses continue to adopt digital payment solutions, the market players identified are at the forefront of providing innovative payment gateway solutions to meet the evolving demands of the market and address the specific requirements of various industries and end-users.**Segments**

Global Platform Based Payment Gateway Market, By Application:

- The market for platform-based payment gateways caters to various segments such as micro and small enterprises, large enterprises, and mid-size enterprises. Each of these segments has unique requirements and preferences when it comes to payment processing solutions. Micro and small enterprises may prioritize cost-effectiveness and ease of use, while large enterprises may focus on scalability and customization options. Mid-size enterprises might seek a balance between features and affordability.

End User:

- The end-user landscape for platform-based payment gateways encompasses industries such as BFSI, media and entertainment, retail and e-commerce, travel and hospitality, and others. Each industry has specific demands concerning payment processing, security, and integration with existing systems. The BFSI sector, for example, requires robust security features and compliance with regulatory standards, while the retail and e-commerce industry needs seamless checkout experiences for customers.

Country:

- The platform-based payment gateway market spans across various countries, including the U.S., copyright, Mexico, Brazil, Argentina, Germany, France, Italy, U.K., Japan, China, India, Australia, UAE, Saudi Arabia, South Africa, and others. Each country has its own regulations, market dynamics, and consumer preferences that influence the adoption of payment gateway solutions. For instance, countries in Asia-Pacific such as China and India are witnessing a surge in digital payments driven by smartphone penetration and government initiatives.

Industry Trends and Forecast to 2032:

- The platform-based payment gateway market is poised for significant growth in the coming years as businesses increasingly shift towards digital payment solutions. Factors such as the rising trend of e-commerce, the proliferation of mobile wallets, and the focus on enhancing customer payment experiences are driving market expansion. With advancements in technology such as blockchain and artificial intelligence, the payment gateway landscape is evolving to offer more secure, efficient, and seamless transactions.

**Market Players**

The major players in the platform-based payment gateway market include Alipay, Amazon, Inc., Wirecard, PesoPay, PayU, PayPal, Paymill, MOLPay, eWAY AU, Net, Worldpay, Beanstream, Stripe, Klarna, Realex, CashU, WebMoney, Pagosonline, 99bill, MyGate, ServiRed, Payson, Cardstream, Sage Pay, e-Path, NAB Transact, MercadoPago, CCBill, and others. These players operate globally and compete in regions such as North America, Europe, Asia-Pacific, Middle East and Africa, and South America. They offer a range of payment gateway solutions tailored to various industries and end-user requirements, leveraging innovation and strategic partnerships to stay competitive in the market. The competitive landscape analysis provided by Databridgemarketresearch gives insights into the strengths and weaknesses of each player, helping businesses make informed decisions and adapt to market trends effectively.

The market is highly fragmented, with a mix of global and regional players competing for market share. To Learn More About the Global Trends Impacting the Future of Top 10 Companies in Platform Based Payment Gateway Market : https://www.databridgemarketresearch.com/reports/global-platform-based-payment-gateway-market/companies

Key Questions Answered by the Global Platform Based Payment Gateway Market Report:

- What is the current state of the Platform Based Payment Gateway Market, and how has it evolved?

- What are the key drivers behind the growth of the Platform Based Payment Gateway Market?

- What challenges and barriers do businesses in the Platform Based Payment Gateway Market face?

- How are technological innovations impacting the Platform Based Payment Gateway Market?

- What emerging trends and opportunities should businesses be aware of in the Platform Based Payment Gateway Market?

Browse More Reports:

https://www.databridgemarketresearch.com/reports/global-smart-farming-market

https://www.databridgemarketresearch.com/reports/global-cell-culture-media-market

https://www.databridgemarketresearch.com/reports/global-bag-in-box-packaging-machine-market

https://www.databridgemarketresearch.com/reports/global-semiconductor-automated-test-equipment-market

https://www.databridgemarketresearch.com/reports/global-snack-food-packaging-market

Data Bridge Market Research:

☎ Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 982

✉ Email: [email protected]" Report this page